More Corporate Developer Subsidies, While Desperate Public Needs Go Unmet

Murphy Is All Corporate Subsidy – No Regulatory Stick

The Devil Literally Is In The Details

The Murphy Economic Development Authority (EDA) is holding zoom public hearings on Sept. 7 and 8 on proposed rules to implement the $300 million Brownfields Redevelopment Tax Credit program (subsidy), a part of Gov. Murphy’s $14 billion NJ Economic Recovery Act (2020).

(read the EDA Brownfields program information and public comment procedures)

Under Gov. Corzine’s policy, the NJ legislature privatized the DEP toxic site cleanup program back in 2009, purportedly to accelerate cleanups and remove “DEP red tape”, which corporate polluters and developers claimed was slowing cleanup progress and redevelopment.

Corporate polluters promised cleanups in exchange for “regulatory relief” and privatization.

NJ has relaxed cleanup regulations, delegated control of cleanups to private consultants, and has been giving huge subsidies to polluters and developers for 3 decades, who claimed that the high cost of complying with DEP environmental and public health regulations made cleanup too costly.

Corporate developers promised community redevelopment in exchange for subsidies.

Those promises were broken – they failed to deliver.

Still, 45 years after passage of NJ’s toxic site cleanup law, thousands of toxic sites (AKA “Brownfields”) have not been cleaned up and the public has not been compensated for destruction of natural resources – including drinking water – caused by toxic corporate polluters.

The Murphy $300 million giveaway repeats the failed privatization and subsidy programs of the past.

We’ve relied almost exclusively on the corporate subsidy carrot and surrendered the DEP stick.

It’s way past time to recognize that failure and for DEP to begin to enforce environmental cleanup laws and mandate cleanups or assume control of the cleanups by DEP contractors.

NJ cleanup laws allow DEP to cleanup sites and bill the polluter 3 times the cleanup cost, an incredible power known as “treble damages”.

That’s a power, to my knowledge, that DEP has never used. Why is that?

(Just imagine if you went to Wall Street with a financial plan that – backed by State law – sought a $1 million development loan that legally guaranteed a $3 million return at a single site, with hundreds more in the pipeline. The bankers would be standing in line to finance that project. Well, that’s exactly the unused power DEP has. Plus, DEP can legally mandate compensation for natural resource damages, thereby increasing the return on investment!)

Compounding the historical “brownfields” failures and subsidy giveaways, the Murphy EDA proposed $300 million provides relief from the corporate business tax (CBT).

Under a Constitutional amendment supported by an overwhelming majority of NJ voters, six percent (6%) of the CBT is dedicated to various environmental programs.

$300 million in tax credits reduces CBT revenue. By my math, that represents a diversion of $18 million in environmental money.

On top of the corporate subsidies and diversion of environmental money, of course we must consider far more important competing unfunded public needs for housing, schools, water, public transit, renewable energy, public health, climate adaptation, health food, parks, etcetera.

Should we be subsidizing corporate developers at times like these? (and how is a decades long failure to cleanup toxic sites in any way related to the economic impacts of COVID, the purported justification for the Gov.’s “Economic Recovery Act” ?

Governor Phil Murphy signed the New Jersey Economic Recovery Act of 2020 (ERA) into law on January 7, 2021. The ERA creates a seven-year, $14 billion package of tax incentive, financing, and grant programs that will address the ongoing economic impacts of the COVID-19 pandemic and build a stronger, fairer New Jersey economy.

Finally, the Murphy EDA brownfields subsidy program itself is flawed – “The Devil is in the details”.

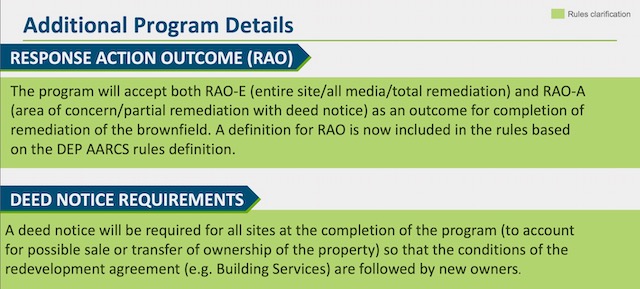

Here’s some of those important details EDA buries under a banner “Additional Program Details”.

The jargon is impenetrable so let me translate:

RAO- A – The EDA will allow subsidies to toxic sites that are not cleaned up. That means incomplete and partial cleanups and sites that still pose threats: e.g. a developer could remove an underground tank and/or small patch of contaminated soil on a small part of a property (receive an RAO-A), and leave massive soil and groundwater contamination across the rest of the site.

Deed Notice: The EDA will allow corporate subsidies to sites where toxic groundwater pollution may be migrating into nearby buildings or poisoning wells or local streams.

Nearby homeowners are not aware of any of that (the DEP cleanup program is privatized) and the deed notice is a real estate tool designed to warn prospective property purchasers, investors, and banks of problems, not the public!

If you doubt that the NJ cleanup law were designed to protect investors, not you, then just think: when was the last time you went to the County Clerk’s Office, dug up the tax maps, got the correct lot/block number, then went and located the deed records, and then read the fine print legalese on the individual property deed for the parcel in question? Law firms and tax record firms are well paid to do that kind of research.

I see no mention of any kind of priorities for allocating the EDA subsidies.

- No mention of land use or the State Plan (has it been repealed? It surely seems to be invisible to the Murphy administration for any other objective than promoting growth and development).

- No mention of environmental justice or community involvement in the cleanup of the site (which has been privatized) or the redevelopment of the property to meet community needs. EDA is required to consider EJ under Murphy’s Executive Order #23. But failure to consider EJ is likely because the EJ law explicitly exempted Brownfields and all other toxic site cleanups (see the definition of “permit” on page 4).

- No mention of climate or energy. And DEP’s toxic site cleanup and brownfields regulations don’t consider GHG emissions or energy consumption.

- No mention of assessing and mandating collection of “Natural Resource Damages” before receiving the subsidies.

As a result, corporate developers and the private real estate market determine environmental and public health priorities for cleanup of toxic sites! Those are DEP’s responsibilities

(see: DEP’s “Remedial Priority System“). Why should Wall Street investors and corporate developers dictate those priorities?

NJ is lost down corporate subsidy road –

I guess that’s just how a former Wall Street millionaire Neoliberal corporate Democrat governs, while we all suffer the costs.