Oil & Gas Pipelines Proliferating

Data show that Obama’s “all of the above” energy policy is maximizing US fossil fuel production

The run-up to the Paris climate conference is all show

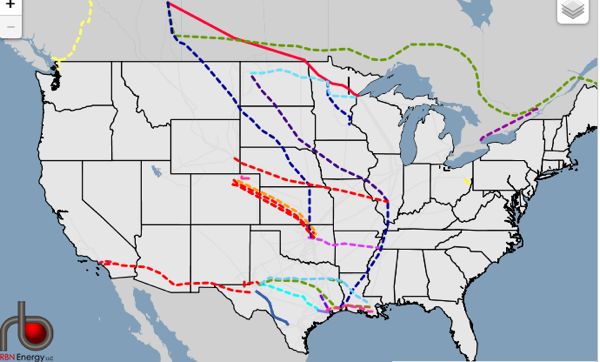

Data supporting this map may be found here – table format can be found here. The energy industry consulting software is known as “MIDI”

The same day that climate activists were declaring victory and the main stream media was making such a big deal about the request by TransCanada to the Obama Administration for a time out in reviewing their Keystone XL pipeline from Canadian tar sands to Gulf of Mexico refineries, an energy consultant known as RBG Energy LLC issued a Report about oil and gas infrastructure in the Gulf.

That report shows massive new imports of oil to Gulf refineries via huge expansions in pipeline capacity, including from the Canadian tar sands. The new pipeline delivery is so large it has displaced prior imports from shipping, and is driving a search for storage capacity for the glut of supply.

Here is the ugly truth printed in energy industry trade journals that is not reported by media or the climate activists:

Prior to 2012 the only U.S. produced crude delivered by pipeline to Houston area refineries came from offshore Gulf of Mexico or onshore Louisiana fields. The majority of supplies were imports delivered by waterborne tanker. But in just three short years between 2012 and 2015, roughly 2 MMb/d of crude pipeline capacity was built or repurposed to deliver surging light shale crude production and heavy crude from Canada into the Houston area. Refiners have adapted quickly to take advantage of new sources of supply. But with much of the newly minted infrastructure underutilized, midstream companies still need to improve pipeline connectivity and storage accessibility to overcome area logistical challenges. Today we review RBN’s latest Drill Down report on Houston crude infrastructure – released today — and announce RBN’s new infrastructure database and mapping system, called MIDI.

In 2011 average waterborne imports to Houston area ports were 1.7 MMb/d – enough to supply more than 70% of local refinery needs. Since April 2012 when Phase 1 of the Seaway pipeline reversal (150 Mb/d) came online to deliver crude from the Midwest Cushing, OK trading hub to Houston, that position has been largely reversed as multiple new pipelines have come online delivering domestic and Canadian crude to the Houston area – pushing out imports in the process. In July 2015 crude delivered by pipelines developed since 2012 accounted for about 55% of Houston supply and waterborne imports had dwindled to 0.8 MMb/d. Our latest Drill Down report – available exclusively to Backstage Pass subscribers provides detailed analysis of the changing crude supply/demand balance for 9 refineries and two condensate splitters in the Houston area that between them consume about 2.4 MMb/d.

The run-up to the Paris climate conference is all show –

The data show that Obama’s “all of the above” energy policy is maximizing US fossil fuel production.

Pingback: WolfeNotes.com » Instead of Rubber Stamping Gas Pipelines and Subsidizing The Energy Industry, Here’s What FERC Should Be Doing On Climate Change