Coal Plant Shutdowns Bailed Out As “Stranded Assets”

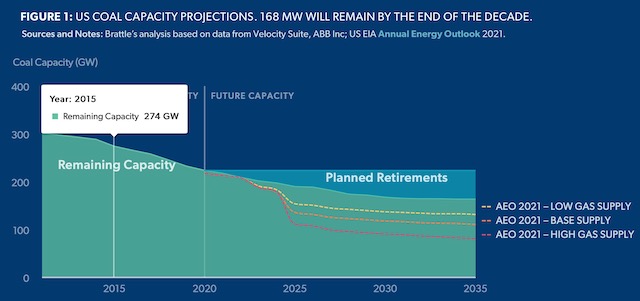

Instead of Complete Shutdown, Huge Coal Capacity Projected To Remain On Line

“PJM will have more coal capacity than any other RTO starting in 2023”

If retired early, such a [coal] plant may be subject to cost recovery risks because investment decisions were made based on the plant’s remaining full lifetime. Across the country, unrecovered coal investments amount to over $100 billion. (Source: The Brattle Group, link to Report below)

The nuclear industry has successfully secured billions of dollars in subsidies designed to keep uncompetitive, dangerous, dinosaur, high cost nuclear plants operating. In NJ alone, legislators and State regulators have provided almost a billion dollars, in just 3 years, and with no end for these $300 million/year subsidies in sight. (The Murphy BPU Energy Master Plan assumes these plants will operate until 2050!)

Hardly mentioned in the nuclear bailout debate is that, in NJ, those same nuke plants were bailed out as “stranded investments” in the 1999 Whitman administration law that deregulated energy production: (see N.J. Utility Shows How to Offset Deregulation Costs

PSE&G, New Jersey’s largest utility was left with more than $3 billion of such stranded assets last year as a result of deregulation, says Busch.

The “lion’s share” of this total consists of the company’s Salem, Hope Creek, Peach Bottom and Limerick nuclear power plants.

Of this, Busch tells CFO.com, state regulators allowed for the recovery of $2.9 billion, $400 million through rate increases and the rest from the utility being able to write off the remaining life of the facilities.

Well, now – making exactly the same bailout arguments – there is another “stranded investment” bailout happening below the radar.

This time, it’s approximately $100 billion nationally for the coal power industry.

Here are the arguments now being made to State regulatory Commissions to support a bailout:

Longstanding and economically well-justified ratemaking principles and standards in the utility industry strongly indicate that all prudently undertaken investments should be fully recoverable from customers, even if the underlying assets should at some point prove less economic than was originally intended. This is particularly important in those instances where retiring those prudent investments is likely to produce net savings to customers (even after accounting for those customers paying for the retired investments) and where disallowing full recovery of those prudent investments would result in an unwarranted windfall to customers and penalize the utility and its investors. (Source: Frank C. Graves, Brattle Group, to the Missouri Public Service Commission on behalf of The Empire District electric Company, May 28, 2012)

Translation: the coal power industry is seeking a massive $100 billion bailout – according to coal industry consultants themselves, see:

This Report was prepared by The Brattle Group.

In addition to bailout subsidies, The Brattle Group is projecting HUGE coal capacity will remain on line.

So, adding insult to injury, it is possible that we will suffer the worst of all worlds: huge subsidies and continuing coal pollution (see:

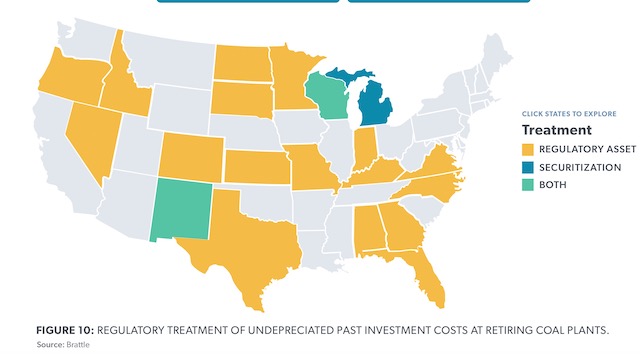

Here is the current status of the State by State treatment of what is clearly a national issue: (I assume coal power industry is pressing Congress, Senator Joe Manchin, and Biden for a national bailout – see below)

Among their other clients, The Brattle Group currently is a consultant to the NJ Board of Public Utilities, i.e.e see The Brattle Group prepared Report, just issued by BPU under cover of BPU:

The thrust of today’s NJ Spotlight story about that Brattle Group report is that NJ reversed it’s “go it alone” independent course and has decided to remain with the PJM grid, because it was a “greener” option:

The reversal is largely due to more receptive approaches by the PJM, the nation’s largest power grid, and the Federal Energy Regulatory Commission as a result of the change in administrations in Washington. The Biden administration is more amenable to accommodating state goals to transition to clean energy than the administration of former President Trump.

Not surprisingly, once again, the facts contradict the NJ Spotlight narrative. PJM will have the most coal in the country! In their coal stranded asset bailout Report, the Brattle Group reported:

Based on announcements to date, PJM will have more coal capacity than any other RTO starting in 2023, though PJM has retired coal capacity at the highest rate

In a remarkable contradiction with their prior Report on managing the coal stranded asset bailout, The Brattle Group Report that NJ Spotlight reports on today as the basis for NJ remaining in the PJM grid makes this it’s first finding:

Based on this evidence, this investigation finds that:

- Incorporating New Jersey’s clean energy goals in the regional market is the most efficient way to provide New Jersey consumers with reliable, affordable, and carbon-free electricity. A clean power grid is necessary to address the crisis of climate change.

How the hell is PJM a “clean power grid” when “it will have more coal capacity than any other RTO starting in 2023”?

How can The Brattle Group and NJ BPU reconcile that blatant contradiction about the need for a “clean grid” and PJM having “more coal capacity than any other” grid ? This was the primary justification for remaining in PJM! (I’m sure Tom Johnson at NJ Spotlight didn’t read the coal stranded asset Brattle report).

This just demonstrates that Brattle is a hired gun and provides the analytical support of what their clients want.

And you can be sure that NJ ratepayers will pay for any PJM coal stranded asset bailout in other states – just like NJ’s nuclear subsidies benefit otters states.

I have not researched this issue. Honestly, I accidentally tripped across it just today upon learning that BPU was using The Brattle Group as a consultant. So I checked out their clients and their work and came upon the coal bailout Report.

It does not inspire confidence that the NJ BPU is relying on a consultant that is a hired gun for the coal industry.

But the abuse and corruption are far worse.

Consider that if the coal power industry is making these arguments on the record to State regulatory commissions – and $100 billion is at stake – you can be certain that they are making even bolder, more aggressive and less well documented arguments quietly to the White House, Congress, State Governors and legislators, and private regional grid entities like PJM, who lack transparency and public accountability.

With Biden’s multi trillion dollar infrastructure and climate plans now before Congress – and Joe Manchin asserting his leverage – there is enormous opportunity for fine print abuse – a $100 billion coal bailout could stay below the radar.

I’ve seen no press coverage or environmental advocacy on this set of issues –

I am aware of Sierra Club’s “Beyond Coal” coal plant shutdown campaign, so I assume it is being addressed there. But, given their desire to see the coal plants shut down, perhaps Sierra is not focused on the bailout side of the issue. (and Bloomberg likes to see investors retain their profits and Wall Street investment firms paid)

Again, there is an important debate going on largely under the radar, so we can assume the public will get screwed again, like they did in the energy deregulation and nuke bailout debates.

So, get ready – bend over – because here it comes!