Lower the price, create the demand. Then raise the price.

“The word in the world of independents is that the shale plays are just giant Ponzi schemes and the economics just do not work” ~~~ NY Times: Insiders Sound an Alarm Amid a Natural Gas Rush (6/25/11)

[Update #3 – 9/1/18 – Op-Ed in NY Times exposes fatal financial flaws and agrees with my initial analysis, see:

A key reason for the terrible financial results is that fracked oil wells show a steep decline rate: The amount of oil they produce in the second year is drastically smaller than the amount produced in the first year. According to an economist at the Kansas City Federal Reserve, production in the average well in the Bakken — a key area for fracking shale in North Dakota — declines 69 percent in its first year and more than 85 percent in its first three years. A conventional well might decline by 10 percent a year. For fracking operations to keep growing, they need huge investments each year to offset the decline from the previous years’ wells.

~~~ end]

[Update #2: 3/9/18 – thus far, the projections and analyses I based my opinions on appear to have been wrong. But time will tell. Long run issues.

[Update #1: 12/6/14 -new study is consistent with my analysis, see:

“That’s when there’s going to be a rude awakening for the United States.” He expects that gas prices will rise steeply, and that the nation may end up building more gas-powered industrial plants and vehicles than it will be able to afford to run. “The bottom line is, no matter what happens and how it unfolds,” he says, “it cannot be good for the US economy.” – end update]

NJ Spotlight reports that the US Energy Information Administration projects a 13% increase in home heating costs this winter nationally, but not in NJ, where – according to industry – gas prices will drop slightly, see: FORECAST: NJ HEATING, ELECTRICITY COSTS WILL DROP THIS WINTER

I talked to Tom Johnson about the EIA forecast, and emphasized the exact opposite conclusion:

“The natural-gas driven industrial renaissance is over,’’ predicted Bill Wolfe, executive director of the New Jersey section of Public Employees for Environmental Responsibility, a public watchdog group. Wolfe argued the huge demand from new natural-gas plants could drive prices up sharply.

Unfortunately, there’s a ton of complexity compressed in that quote, so let me briefly expand upon what I was driving at. I was not just focused on increased demand.

Basically, there are 3 inter-related things going on – the first two on the supply side and the third on the demand side:

- recoverable gas reserves have been greatly exaggerated;

- data on individual fracking wells show steep depletion curves – up to 70% in first year. More wells, less production;

- demand for gas is booming, especially as coal power plants switch to natural gas;

That all boils down to far less gas supply and a hugely growing demand, and declining returns on drilling investments, a formula for price spikes and reliability concerns. Some call this a “drilling treadmill”, some a Ponzi scheme.[Exclusive of industry’s proposed plans for large exports of US gas.]

In fact, although made more complex by pipeline transmission capacity issues, there is already an event that suggests where gas markets are headed. There was a gas crises last winter in New England and in the Southwestern US, where prices increased tenfold and gas fired power plants were unable to operate due to lack of gas (see also: Energy experts offer solutions to prevent a New England natural gas crisis)

Here’s an example of how the industry lies: (see: What the Frack? Is there really 100 years worth of natural gas beneath the US?

An example of how inflated initial resource claims can be, and how they can be sharply cut, presented itself in August with a new assessment of the Marcellus shale by the U.S. Geological Survey. It offered a range of estimates, from 43 tcf at 95 percent probability, to 84 tcf at 50 percent probability, to 114 tcf at 5 percent probability. (Not surprisingly, the 95 percent probable estimates have proven historically to be closest to the mark.) Only five months earlier, the EIA speculated in its Annual Energy Outlook 2011 that the Marcellus might have an “estimated technically recoverable resource base of about 400 trillion cubic feet.” The USGS reassessment had slashed the estimate for the Marcellus by 80 percent. Similar adjustments may be ahead for other shale plays.

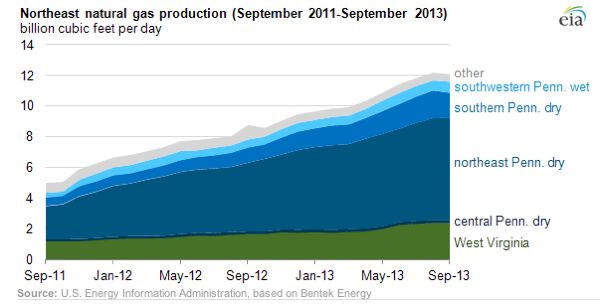

In addition to USGS, many professional energy analysts suggest that the gas industry’s claims of an abundant, cheap, 100 year supply of fracking gas are grossly exaggerated. A key aspect of that argument is embedded in the graph above.

This exaggerated claim by the gas industry has led related petrochemical industries to talk about fracking as a “game changer” that will lead to a US “industrial renaissance” (see NY Times business page for an example of that cheerleading: Natural Gas Signals a ‘Manufacturing Renaissance’)

Even the EIA presents data on short term production in a way that reinforces that exagerated claim, see this from today’s EIA release: – notice how there is no right hand side to that graph, which creates the impression that huge growth will continue into the future, and masks the declines in individual well productivity:

But, other analysts disagree and raise disturbing questions:

Shale gas has become an important and permanent feature of U.S. energy supply. Daily production has increased from less than 1 billion cubic feet of gas per day (bcfd) in 2003, when the first modern horizontal drilling and fracture stimulation was used, to almost 20 bcfd by mid-2011.

There are, however, two major concerns at the center of the shale gas revolution:

• Despite impressive production growth, it is not yet clear that these plays are commercial at current prices because of the high capital costs of land and drilling and completion.

• Reserves and economics depend on estimated ultimate recoveries based on hyperbolic, or increasingly flattening, decline profiles that predict decades of commercial production. With only a few years of production history in most of these plays, this model has not been shown to be correct, and may be overly optimistic.

These are not purely technical topics for debate among petroleum professionals. The marketing of the shale gas phenomenon has been so effective that important policy and strategic decisions are being made based on as yet unproven assumptions about the abundance and low cost of these plays. The “Pickens Plan” seeks to get congressional approval for natural gas subsidies that might eventually lead to conversion of large parts of our vehicle fleet to run on natural gas. Similarly, companies have gotten permits from the government to transform liquefied natural gas import terminals into export facilities that would commit the U.S. to decades of large, fixed export volumes. This might commit the U.S. to decades of natural gas exports at fixed prices in the face of scarcity and increasing prices in the domestic market. If reserves are less and cost is more than many assume, these could be disastrous decisions.

Disastrous decsions – like using scarce resources to convert all our power plants to gas, instead of investing in efficiency and renewables. Or developing natural gas infrastructure for truck and cars, instead of mass transit and electric cars.

You can watch YouTube interview summary that explains it all here: The Economics of Fracking (extended version lecture: Shale Gas or Shell Game?)

So, there are credible indications that instead of a renaissance, the fracking bubble is about to burst and the Ponzi scheme will crash and burn.

Pingback: Is Fracking for Shale Oil or Natural Gas A Ponzi Scheme? | Frack Free Illinois

Pingback: Is Fracking for Shale Oil or Natural Gas A Ponzi Scheme? | Chicago Activism

Pingback: wildstar platinums

Pingback: befoam afterlove bottleholder

Pingback: Roger Vivier shoes

Pingback: roger vivier online

Pingback: fitflop

Pingback: mbt pas cher

Pingback: شركة تنظيف

Pingback: pengertian siswa

Pingback: limbah domestik

Pingback: contoh limbah rumah tangga

Pingback: pengertian keterampilan

Pingback: signifikan adalah

Pingback: observasi adalah

Pingback: contoh qiyas

Pingback: pengertian penduduk dan bukan penduduk

Pingback: variabel bebas dan terikat

Pingback: limbah domestik

Pingback: pengertian observasi

Pingback: arti signifikan

Pingback: pengertian observasi

Pingback: karangan argumentasi

Pingback: pengertian komunitas

Pingback: pengertian administrasi

Pingback: pengertian penduduk dan bukan penduduk

Pingback: pengertian demonstrasi

Pingback: pengertian dokumentasi

Pingback: variabel bebas dan terikat

Pingback: contoh karangan argumentasi

Pingback: pengertian hasil belajar

Pingback: pengertian siswa

Pingback: nike roshe run mid top

Pingback: jodoh dalam islam

Pingback: pengertian budaya

Pingback: pengertian pelajar

Pingback: pengertian budaya menurut para ahli

Pingback: pengertian israf

Pingback: variabel bebas

Pingback: nitrocellulose chips

Pingback: Sodium Sesquicarbonate

Pingback: Dibutyl Phthalate

Pingback: Palisade Fence

Pingback: nike mercurial vapor 5 for sale