Highly Touted “Transformative” Electric Vehicle Program Has Negligible – If ANY – Impact On Greenhouse Gas Emissions

Proponents did not even attempt to quantify greenhouse gas emissions

Number of EV’s On Road Goals Are Based on 16 Year Old Clean Car Legislation

In recent years, our politics has tended toward incremental proposals made up of small policies designed to avoid offending special interests, alternating with occasional baby steps in the right direction. Our democracy has become sclerotic at a time when these crises require boldness. ~~~ Al Gore (7/20/08), quoted here.

The transportation sector historically has had the highest carbon intensity, which continues in the projection because carbon-intensive petroleum remains the dominant fuel used in vehicles throughout the projection period. ~~~ US Energy Information Administration 2020 Forecast

I’ve posted 3 times now on major flaws in the NJ electric vehicle legislation signed into law last Friday (see this and this and this).

But according to Gov. Murphy: (emphases mine)

Increasing the use of electric vehicles is a critical step to secure New Jersey’s clean energy future. By establishing aggressive goals and strong incentives for electric vehicles, we are repositioning our economy and state for a clean future. Today, I am proudly signing bipartisan legislation that will transform New Jersey’s transportation sector and modernize our infrastructure to support our goal of reaching 100 percent clean energy by 2050.

After watching the shameless self congratulation, self promotion, and fawning praise and sycophantic spin during the Gov.’s bill signing ceremony – watch it on You Tube – today we provide the most recent and readily accessible DEP greenhouse gas emissions data to try to fact check Gov. Murphy’s claims and to get a back of the envelope quantitative sense of what this highly touted EV program means in terms of reducing greenhouse gas emissions – and whether reductions will comport with the urgent timeframe based on science.

We will try to make this simple, even for the math challenged. I urge supporters of the bill to email me to tell me what I missed, got wrong, and/or left out.

1. The EV goals are not “aggressive”

We start by noting that the EV law created what has been described as an “aggressive goal” of 330,000 electric vehicles on the road by the year 2025.

The law does have more aggressive goals in the out years, but any GHG emissions reductions would occur past 2030, which is well past the vanishing 10 year window that climate scientists have warned that we have to dramatically reduce emissions to avoid catastrophic impacts.

That may sound aggressive in light of the fact that, according to DEP (@p.11), there were only 26,840 EV’s on the road in 2019. That’s about only 1% of approximately 3 million NJ registered passenger cars (2.8 million, in 2017) – and that doesn’t count trucks and buses and other transportation sector GHG emissions (more on that below).

But Gov. Murphy’s 2025 EV goal is already current law, based on the “California Car” law passed by the legislature in 2004, 16 years ago. NJ has failed to make real progress towards meeting that 16 year old goal. As NJ Spotlight noted:

By 2025, New Jersey is supposed to have more than 300,000 ZEVs on the road, a mandate it has to meet under the California low-emission car program it has agreed to comply with, along with 12 other states and jurisdictions.

So, Gov. Murphy’s “transformative” EV program is based on an EV on road goal that is little more than the 16 year old legal status quo, at least over a realistic 5 year planning horizon.

2. DEP GHG Emissions Inventory Underestimates Total Emissions –

The BEST CASE EV program would have a negligible impact on total greenhouse gas emissions

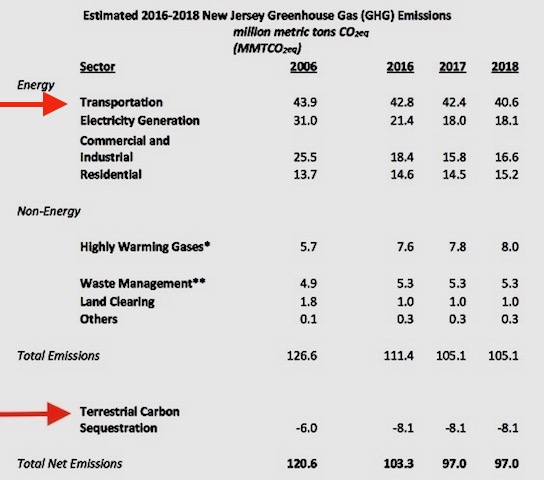

Now let’s look at the EV program in light of the most recent data on total annual NJ GHG emissions, according to NJ DEP’s most recently Greenhouse Gas Inventory:

Transportation sector emissions are discussed starting on page 8 – there is no mention of aviation, rail, or shipping impacts or lifecycle impacts.

According to DEP, the transportation sector accounts for 40.6 million tons, or 38.7% of total 2018 GHG emissions.

That DEP total does NOT include GHG emission from aviation, rail, or shipping, which are huge in NJ, given Newark airport and the Ports.

NJ is an urban, coastal, metropolitan corridor state, home of some of the nation’s largest airports, ports, and commercial and recreational shipping. For DEP to ignore GHG emission from those activities would be like Kansas or Iowa ignoring corn, soybean and wheat production impacts in their agricultural inventory. Absurd.

The GHG emissions DEP left out of the inventory are larger than any emissions reductions that might result from the EV program from now until after 2030.

In contrast, the NJ Transportation Planning Authority conducted a GHG inventory that did consider aviation, rail and shipping. It also included “upstream” – or lifecycle emissions:

Energy‐Cycle Emissions

Energy‐cycle emissions associated with fuel extraction, refining, transport and delivery (upstream emissions) were included for all fuels. Energy‐cycle emissions, including upstream emissions for biogenic and fossil fuels, as appropriate, were developed using the GREET model.

upstream production of a product or process, called energy‐cycle emissions, which include emissions associated with material extraction, processing, and transport. For example, the extraction, distribution, and refining of gasoline is often not considered in the direct emissions accounting, but is included in a consumption/energy cycle accounting method. Measuring greenhouse gas emissions by using both methods provide a more nuanced and complete picture of where greenhouse gas are being emitted and provides additional guidance on what GHG mitigation measures may be pursued.

According to NJTPA, “upstream” emissions are significant:

The GREET model does not have an energy‐cycle emissions estimate specifically for aviation fuels, so diesel fuel was used as a surrogate. This produced a 24.8 percent increase in emissions when energy‐cycle emissions are considered.

According to NJTPA, aviation accounts for about 2 million tons GHG emission (in 2020). Marine vessels account for an additional 650,000 tons, and rail more than 1.2 million tons. That’s a total of 3.85 million tons DEP does not consider (and that’s only for the north jersey NJTPA region, not statewide ).

So, NJ DEP’s GHG inventory is WAY TOO LOW because it does not include energy life-cycle emissions (up to an additional 25%) or emissions from aviation, rail, and marine vessels.

But before going deeper into the weeds of GHG inventory and projection methods, let’s get back to the EV program. But we will note, regarding emissions inventories, of course, that as the real GHG emissions increase, that diminishes the impact of EV’s on total GHG emissions. If DEP’s estimates are WAY TOO LOW, that means the EV programs impact is even SMALLER than we estimate here.

We will assume that the EV law applies primarily to passenger and light duty vehicles, similar to the California Car law, which according to DEP:

The [California Car] rules are applicable to 2009 and newer light duty motor vehicles less than or equal to 8,500 lbs. Gross Vehicle Weight Rating (GVWR) that are sold or registered in New Jersey. It does not include medium-duty vehicles, off-highway vehicles, all- terrain vehicles and motorcycles.

According to DEP data, passenger vehicles account for 40% of the vehicle emissions, or 16.2 million tons, or 15.4% of total emissions. Passenger trucks and light commercial trucks are 57%, but only a portion of those are subject to the EV law and I can’t get the data due to DEP’s formatting.

DEP breaks this transportation sector GHG emission data further.

So, BEST CASE, assuming the 2025 goal of 330,000 EV’s on the road is met, that EV’s represent about 10% of the total passenger vehicle fleet, every EV replaces an internal combustion engine car, and all other GHG emission factors remain constant, the 2025 EV goal would reduce GHG emissions by less than 1.6 million tons, or less than 1.5%.(and that is FAR less that the carbon that is sequestered in NJ forests – more on that issue in a future post).

Is a 1.5% GHG emissions reduction “transformative” change, as Gov. Murphy claims?

For many reasons, we have little confidence that the BEST CASE will actually be achieved.

We know that all other assumed GHG emission factors will not remain constant.

As I’ve noted, there has been little progress over the last 16 years in meeting the California Car EV goals. Worse, the new EV law’s goals are aspirational: there are no enforcement sticks to provide incentives for compliance or deterrence for violations.

The law does not mandate that a new EV force the retirement of an internal combustion engine or that total internal combustion vehicles or total vehicle miles travelled or total GHG emissions be reduced.

In addition to those statutory flaws, there are technical issues to consider.

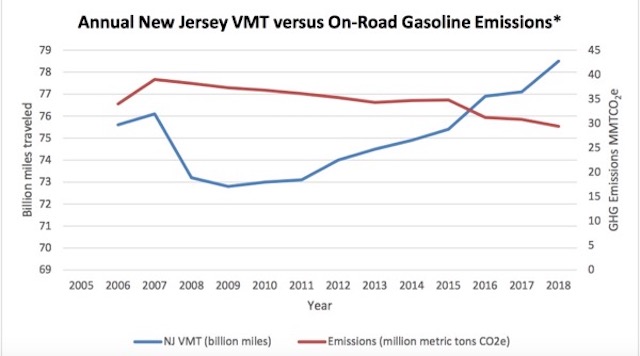

The number of vehicles (all vehicles, including trucks and buses) and the vehicle miles traveled by passenger vehicles all will increase.

Nationally, vehicle miles travelled have increased by 28.5% from 1994 – 2018.

These increases are very likely to significantly reduce, if not wipe out, the small emissions reductions associated with the EV program. Just look at the NJ VMT and emissions data:

As shown in Figure 2, these [GHG emission] reductions occurred against the background of continuing growth in vehicle miles traveled (VMT) since the economic recovery in 2010 (VMT declined during the 2008-2009 economic recession).

Economic growth will drive increases in GHG emissions from other sectors, again reducing the impact of the EV program on total emissions, but that analysis is beyond our scope.

Finally, the EV legislation diverted $300 million, over 10 years, from the RGGI funds and Clean Energy Fund (including energy efficiency and low income energy assistance) to pay for the EV rebates. These programs that were defunded provided some greenhouse gas emission reductions. These emissions reductions must be subtracted from any reductions associated with the EV program.

It is possible that the RGGI & Clean Energy Fund programs that were defunded provided MORE current GHG emissions reductions than those future reductions that might result from the EV rebate program. Thus, the EV rebate program could end up increasing emissions, even under the BEST CASE scenario!

3. Conclusions

So, with all that in mind, let me finish with a few conclusions:

1. the 2004 Clean Car (California car) program is incredibly complex, including a myriad of credits. I could not make sense of it on basic facts, like who is responsible for meeting the goals, what happens if they are not met, and how many cars must be EV’s.

The NJ EV law seems to replicate these flaws.

2. The 2004 NJ Clean Car law set a goal of 330,000 EV’s on the road by 2025, according to press reports (I could not find that number in government documents).

3. The NJ 2020 EV legislation, claimed to be “transformative change”, set the SAME 330,000 by 2025 goal!

4. For context, there are about 2.8 million registered cars in NJ (2016 data, doesn’t include trucks, buses, et al)

5. Vehicle miles travelled have increased by 28.5% from 1994 – 2018.

6. The EV legislation provides $300 million over 10 years (not NEW money, but a deeply regressive diversion of existing RGGI climate money and BPU Societal Benefit Charge low income energy assistance money) to give car purchasers a $5,000 rebate. At $5K a pop, that’s only 60,000 EV’s – just a fraction of the 330,000 goal.

Based on these facts, I conclude that, even if the EV goal are met – which is highly unlikely – that GHG emissions from the transportation sector will INCREASE, despite any reductions in emissions growth associated with EV’s.

On top of that, there is no data – and no attempt to evaluate – the alleged GHG emissions reductions associated with EV’s with the emissions reductions from the RGGI and SBC energy programs from with the $300 million was diverted.

It is possible that diversion of the SBC money to the EV program will actually INCREASE GHG emissions, because other uses of SBC money may be more cost effective in terms of reductions of GHG per dollar invested.

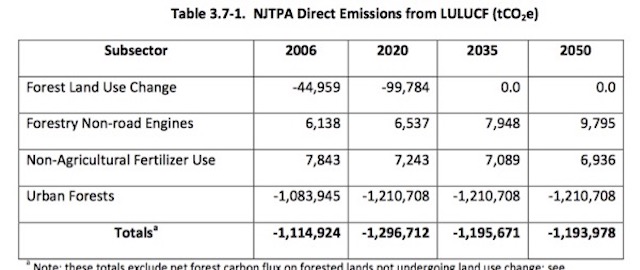

And I was pleasantly surprised by the role of urban forests in sequestering carbon: