NRDC Consultant Supports Market Based Policy That Diverts From “Strategic Retreat”

Repetitive Flood Claims Fueled By NJ’s “Right To Rebuild” Laws & Lax Regulation

Serious Reforms Require A “One And Done” Approach

Almost 2 years ago, Murphy DEP Commissioner Shawn Latourette made highly revealing and hugely embarrassing on the record comments.

LaTourette suggested that market based real estate risk disclosure was an important tool to reduce risks of flooding, and could serve as an alternative to strict DEP land use planning and regulation: (NJ Spotlight, 10/14/20 – emphases mine)

Although developers and builders fear the new rules will tighten limits on where they can build in coastal and inland areas, the regulations are unlikely to do that, LaTourette said in an interview with NJ Spotlight News.

While no final decisions have been taken, the regulations are likely to require instead that builders and developers do a “climate impact analysis” for any new property that would be built in an area that’s expected to be hit by future floods, given scientific forecasts for sea-level rise and other climate-change phenomena, he said.

“We’re not at a point, nor do we think it’s our role, to tell people: ‘Don’t build here, you shouldn’t build there, you can’t do that,’” LaTourette said. “It is about making folks assess their risk and recognize the risk they are taking on. We are not saying: ‘You cannot build in a future flood-risk area.’ We’re saying that in a future flood-risk area, you need to at least do what you do now in an existing flood-risk area, which is: assess the risk, and notice that risk. It will forever live in the deed record of that property.” […]

“What’s important right now is that we make sure that people know that time is coming,” he said. “People writ large do not recognize it. By taking these kinds of measures and making people look at what’s happening, you begin to change the conversation, you begin to influence the risk that people are willing to take on.

At the time, I called him out for trying to substitute real estate market tools for his responsibility to regulate development, see:

Such an approach abdicates DEP’s public responsibility and inappropriately relies on information disclosure and individual private market based incentives to address deadly risks and catastrophic property damage.

Shortly after, LaTourette tried to walk back those comments and attacked his critics:

In another stunning set of absurd remarks, Mr. LaTourette falsely attacks critics:

- DEP warns environmentalists not to prejudge climate regulation review (NJ Spotlight, emphasis mine)

LaTourette said the critics were wrong to conclude that the DEP would leave it up to an individual to decide whether it was safe to build a house in a particular location.

“They have nothing to react to at this point,” he said. “For folks to jump to the conclusion that what we may propose to help ready our state to face this great risk, for folks to presuppose that whatever it is won’t be good enough, that’s not following the science.” […]

Bill Wolfe, a retired DEP policy analyst and the current author of an environmental blog, said the [LaTourette] comments “reflect an astonishing abdication of DEP’s regulatory responsibilities,” particularly coming from an administration that claims to be a leader in battling climate change.

“DEP must regulate to achieve deep emissions reductions and reduce risks as clearly reflected by an overwhelming scientific consensus,” Wolfe said. “Delay only makes matters worse.”

Wolfe argued that the DEP is required to regulate development under several laws, including the Flood Hazard Area Control Act and the Coastal Area Facilities Review Act.

Now, the Natural Resources Defense Council (NRDC) and the corporate planning group NJ Future have teamed up to provide cover for exactly that market based approach that LaTourette advocated. And they did so with no mention of long delayed DEP climate PACT regulations.

Today, NJ Spotlight reports on an “report for” NRDC (the vague “for NRDC” masks the fact that the Report was written by Milliman Inc., a private sector actuarial consulting firm, an important fact not disclosed in the Spotlight story, which misleads readers into thinking the Report was an NRDC product).

Once again, while promoting ineffective business friendly market based solutions, the Spotlight reporting ignores important issues, including the fact that – as I’ve written many times – NJ’s “right to rebuild” laws and lax regulation of development in flood prone areas are the drivers of NJ’s repetitive flood damage problem.

Real solutions to these problems would require a completely new DEP planning and regulatory strategy of “strategic retreat”, which would include legislatively revoking NJ right to rebuild laws and far more stringent DEP regulation of development in flood prone areas.

There was even legislation introduced to revoke the right to rebuild. As I wrote:

The Problem: (source: Huffington Post)

“New Jersey’s guaranteed right to rebuild following storm damage stands out as a highly unusual provision, according to a Huffington Post review of coastal laws in more than a dozen states on the Atlantic and the Gulf of Mexico.

North Carolina, for example, generally bars rebuilding in the same place after a structure is substantially damaged by a storm. Florida and Alabama typically require state reviews before approving the rebuilding of coastal structures damaged in major storms. Several other states, including South Carolina and Maine, require that property owners pull back from the ocean as much as possible following hurricane damage.

Experts describe New Jersey’s express right to rebuild as the single most significant impediment toward limiting the state’s vulnerability to future storms.

“The idea of putting it down on paper like that is strange, that’s not good,” said Orrin H. Pilkey, an emeritus professor of earth and ocean sciences at Duke University, who has probed the dangers of building near disappearing shorelines. “It gives you no flexibility. If people want to rebuild, they can.” ~~~ see: Jersey Shore Development Failures Exposed By Hurricane Sandy

The Solution:

A bill (S62 – Barnes) that would rescind the so called “right to rebuild” storm damaged property in NJ’s Coastal Zone was approved by the Senate Environment Committee last week, with surprisingly little debate or opposition.

But instead of even opening that Pandora’s box, here are the key findings Spotlight reported:

Over the length of a 15-year mortgage, the owner of a previously flooded home can see estimated damages rise from $25,175 under current climate conditions to $32,707 under “medium” carbon emissions, and $50,756 if governments completely fail to curb emissions, said the report, titled “Estimating Undisclosed Flood Risk in Real Estate Transactions.”

Over a 30-year mortgage, the owner of a previously flooded home can expect to see flood damages rise from $50,351 to $55,415 under “medium” carbon emissions and $101,513 under a “high” carbon scenario, the report said.

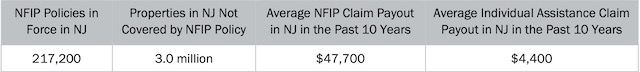

NRDC didn’t need to pay a corporate consulting firm big money for that analysis – just 3 weeks ago I reported publicly available FEMA data that shows that the average flood insurance claim in NJ over the last 10 years was $47,700

Of course the economic value of those damages will increase as climate risks increase and more expensive real estate is rebuilt in the same hazardous location! (Paraphrasing Dylan) You don’t need a [corporate consultant] weatherman to know which way the wind blows!

But instead of economics and Neoliberal market based solutions, I wrote to focus on how DEP regulatory delays were exacerbating these problems:

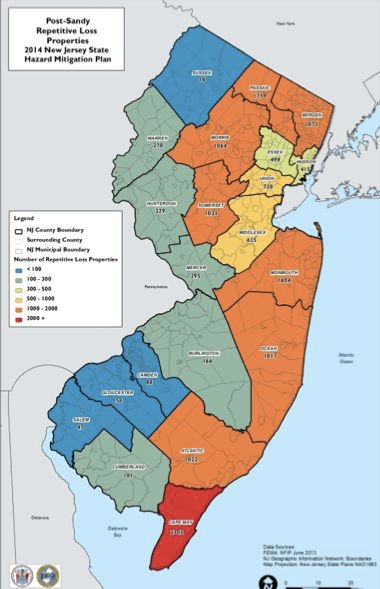

Equally disturbing, during this delay, DEP has approved hundreds of land use permits and related approvals that put even more people and property in harms way, thereby exacerbating NJ’s national negative profile as a FEMA “repetitive loss” State.

Why aren’t NRDC and NJ Future advocating for real solutions to the costly and dangerous flood issues that plague NJ?

Why are they tinkering around the margins with diversionary business friendly market tools instead of educating the public about and advocating for real regulatory and planning solutions?

Those are the kind of questions real journalists would be asking and writing stories about.