Renewable Energy and Environmental Protections Blamed for Job Loss

Last year, NJ Monthly magazine ran an extensive article on NJ energy policy: Brownouts Loom as Demand Outpaces Supply – Brownouts could loom for New Jersey as our growing demand outpaces existing supply

Although reporter Caren Chesler did a good job of counterposing facts and perspectives to implicitly rebut the spin (fair and balanced and all that), beginning with the hyped headline, the article features familiar myths – almost like an Onion parody – Â and the same repertoire of scare tactics by the usual suspects; e.g.

- demand for power is growing and projected to rise

That New Jersey’s energy needs by 2021 will exceed supply is hardly in doubt, and, despite the best intentions of the green movement, many experts say it is going to take more than extra insulation, wind farms and solar panels to meet the growing demand.

But energy demand growth is very much in doubt – demand is falling and projected rates of growth are not realistic. I invite Readers to please submit links documenting this.

- the lights could go out if we don’t build more power plants and transmission lines;

The state is in a bind because no new power plants of significant output are being built here, and yet demand, particularly during the peak summer months, is expected to rise 1.3 percent to 2.8 percent annually over the next 10 years. That means the state’s energy needs could exceed supply as soon as 2012, energy observers say. The result could be brownouts and even blackouts during high-demand periods.

Scare tactic – again readers back me up here with the analysis, I’m too lazy. And regardless of the shape of demand, conservation, efficiency, renewables, and distributed power are the solutions.

- EPA greenhouse gas emissions regulations will shut down coal power plants and jeopardize reliability

The problem could be exacerbated by expected federal pollution regulations aimed at reducing greenhouse gases. The potential new rules could shutter some of the region’s existing coal-fired power plants, cutting deeper into the state’s energy supply.

First of all, EPA’s “tailoring” and “NSR” GHG regulations basically grandfather existing plants or delegate plant closure decisions to States. And even Obama’s industry friendly EPA and Energy Department didn’t agree with the reliability scare – see this, for example.

- nuclear power is the “lowest cost” energy and needed to combat global warming

Oyster Creek puts out 645 megawatts of electricity, or enough to power 600,000 homes per year. Along with New Jersey’s three other nuclear generating facilities, it accounts for more than half of the state’s electricity—and at the lowest cost of all power sources currently available here. […]

Nuclear plants are considered favorable for the environment, because they do not emit the greenhouse gases of plants that use fossil fuels.

But, if nukes are the “lowest cost” power source, how can this also be true?

Then there’s the staggering cost of new plant construction, estimated at $10 billion to $14 billion. Experts agree this will increase the cost of nuclear energy from future plants, should they be built. “Nukes are definitely not cheap,†says Steven Goldenberg, an attorney with Fox Rothschild LLP, “but they are necessary from a cost/reliability/greenhouse-gas perspective.â€

Does this mean Governor Christie is willing to spend billions of taxpayer and ratepayer dollars to subsidize avoidance of greenhouse gas emissions, but only if the money is spent on high cost, above market nuke power plant construction?

Does the Governor have a grasp of engineering economics and what relative or ranked ROI means?

Hint for our Good Governor: Google “Amory Lovins”. Investments in “megawatts”, efficiency and renewables have far higher ROI’s; far shorter implementation timeframes; far higher jobs to dollar invested ratio’s, and lower overall environmental impact and financial risk profiles. HELLO!

- renewable energy is heavily subsidized and not economically feasible;

Proponents of solar say it is clean, renewable and produces energy when needed most—in the middle of the day. Criticism of solar (and wind) energy comes largely from representatives of the state’s biggest energy users, such as the chemical industry. They say solar is unreliable and costly—about 40 to 75 cents a kilowatt hour—and that solar construction is largely driven by state and federal subsidies, a cost ultimately borne by ratepayers.

Bill Potter at NJ Spotlight destroyed this spin, see: Solar Oppostion: Left. Right. Wrong.

- energy policy incentives drive high enery costs;

“Right now, New Jersey businesses pay higher rates than the national average, and we’re one of the highest in our electric grid,†says Sara Bluhm, an assistant vice president at the New Jersey Business & Industry Association. “That puts us at a competitive disadvantage.â€

The state’s energy costs are high for a variety of reasons. New Jersey imports a significant amount of its power, which itself costs more. But under the PJM pricing model, we also subsidize power-plant construction in other states.Â

New Jersey’s large energy users also complain about fees and charges tacked on by the state, which add up to about 26 percent of a residential electric bill. These include the societal benefits charge, which pays for things like renewable power subsidies and assistance to low-income customers. There’s a also a 7 percent sales tax, a 6 percent transitional energy facilities assessment tax and a regional greenhouse gas initiative charge, which goes toward reducing greenhouse gases. Large energy users say the latter charge alone costs them hundreds of thousands of dollars each year.

- high energy costs are killing  jobs and driving business out of the state;

“About a quarter of the bill comes from state policy, so there’s some room for change,†says Bluhm.

Indeed, state officials recently removed the retail margin tax. The fee, which ends in June, was meant to incentivize businesses to shop around for power. The tax cost business more than $12 million a year, Bluhm says.

“We’re encouraged [the Christie administration] will be looking at other taxes and fees and how they can chip away at that 26 percent,†Bluhm says.

Each and every one of those premises is either incomplete, half true, irrelevant, misleading, or flat out false.

But, if you link and follow the logic of this chain of falsehoods and half truths, the overall policy solution is pretty clear:Â scale back renewable energy goals; scrap costly global warming mitigation programs; build more in state power plant capacity and distribution infrastructure; eliminate subsidies to renewables to lower energy costs in order to grow jobs and the economy.

Obviously, if you build your policy solution on a problem diagnosis based on myths and lies, you enter the realm of the medieval doctor’s prescription of leeches – you bleed the patient to death.

At that is exactly what Governor Christie is doing. Taking the wrong energy path, to invoke energy guru Daniel Yergin.

But I really don’t want to focus now on a point by point rebuttal of these energy policy half truths, spin and outright lies. I’ve done some of that before (see:

- Enter the Twilight Zone of Energy Poilicy

- Christie BPU: $3 per year to Support Solar “Too High“

- NJ Pays Over $1.5 Billion to Keep Obsolete Coal Plants Open

- Christie RGGI Withdrawal Plan Slammed at Trenton Hearing

- Fact Check Christie Claims on Energy

Rather, I’d like to show how blatantly false claims by lobbyists form the foundation and political cover for both energy and environmental policy rollbacks under the Christie Administration.

It is important to note at the outset that Christie energy and environmental policies share very similar – – in some cases the same – foundational lies and half truths, that are told by the same people and organizations, for the same reasons.

Hal Bozarth, NJ Chemistry Council

Following Hal’s lead, Hal’s sidekick testified (lied) to the  Assembly Environment Committee last month by using the lowest form of innuendo to imply that the Regional Greenhouse Gas Initiative was responsible for the loss of almost 30,000 manufacturing jobs in the NJ chemical industry.

Really, he did. I guess Politifact missed that one.

Now if a lie falls on the legislature’s forest, but Politicfact is not there to hear it ….

Not to be outdone, Hal Bozarth himself set the tone and deployed this whopper in the NJ monthly story – on the record and for attribution:

Hal Bozarth, executive director of the Chemistry Council of New Jersey, which represents some of the state’s biggest energy consumers, claims the cost of energy here is driving companies out of the state—to the tune of about 4,000 jobs. In February 2009, for instance, Griffin Pipe Products shuttered its Florence plant, resulting in a loss of 400 jobs. More recently, Gerdau Ameristeel Corp. said it was closing its Perth Amboy plant and reducing production at its Sayreville plant. Bozarth ties these moves to energy costs coupled with the bad economy.

“New Jersey’s unusually high cost of electricity is killing us,†Bozarth says. “These people literally vote with their feet.â€

So, let’s look at the Griffin Pipe and Gerdau AMeristeel plants to see if we can find out what drove them to shut down operations in NJ.

Griffin Pipe.

Griffen Pipe closed down for the same reason the US Pipe plant just down the road closed: lack of demand due to global economic recession.

Here is what the New York Times had to say:

“We were expecting a temporary layoff, maybe three months,†said Mark Babula, 38, unit chairman of Local 2040B of the United Steelworkers, the union that represents 175 hourly employees at Griffin. But the economy was worse than anyone had ever imagined: Housing starts had plummeted, and so had the demand for water pipes. Just a year earlier, just three miles downriver in Burlington, another old foundry, U.S. Pipe, had closed.

Hal Bozarth is full of shit – strike one.

Gerdau Ameristeel

Gerdau Ameristeel shut down its Sayreville NJ plant for the same reason it shut down its Sand Springs, Oklahoma plant – “due to lower demand for its products resulting from the downturn in the economy”:

MIDDLESEX COUNTY — The Flordia-based steel company that operates two steel plants in the county has announced they will be suspending its Sayreville steel mill and will close its Perth Amboy facility due to a decrease in demand for products, according to a report by NJBIZ.com.

Suburban News

Sayreville steel mill suspends productionMarket conditions prompt Gerdau Ameristeel closuresBY MICHAEL ACKER Staff WriterA Sayreville steel mill announced this week that it is suspending production in the borough and closing a mill in a neighboring town due to the downturn in the economy.

American Recycler (Trade journal)

Gerdau Ameristeel Corporation is suspending production at its Sayreville, New Jersey steel mill and closing its rolling mill in neighboring Perth Amboy, New Jersey due to lower demand for its products resulting from the downturn in the economy. The company said these actions are expected to occur gradually over the next several months. The company indicated that it would restart operations at the Sayreville facility when business conditions warrant.

The company is also entering into discussions with the United Steel Workers regarding the potential closure of the Company’s steel mill located in Sand Springs, Oklahoma.

Hal Boarth is full of shit – strike two.

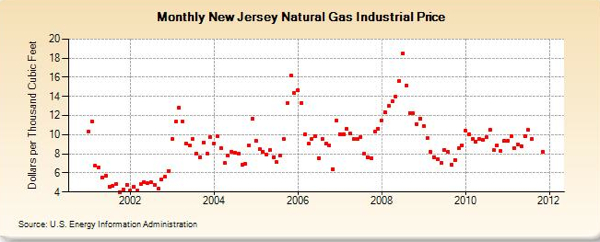

But I saved the best for last – so go back up and take a look at the graph at the top of this post. It shows recent trends in industrial sector natural gas prices.

First of all, the Gerdau plant uses lots of natural gas in manufacturing – not electricity as Bozarth suggested.

Second, the Gerdau plant, In August 2007 – Â shortly before the global economy crashed and the decision was made to shut down the plant – under went an Energy Savings Assessment (ESA) by the US Department of Energy.

The ESA found that the Gerdau plant management was “very active in exploring and implementing energy savings practices” and  “extremely interested in pursuing energy savings opportunities“.

The  DOE ESA concluded:

Reported values of natural gas consumption for this plant are in excess of 450,000 MMBTU per year, approximate annual natural gas cost for the plant is estimated to be about $8 per million Btu.

Potential opportunities: Major energy saving opportunities identified during this assessment are described briefly below. A large percentage (>85%) of the total natural gas used in the plant is used in reheat furnace and the plant has installed a modern furnace that is designed for very efficient operation. In additional to this the pant operating practices allow them to use 50% or more hot charging in the furnace. This has resulted in excellent operating performance for the reheat furnace.

Main areas of improvement are reported for three heating equipment: Reheat furnace, Tundish heaters and Ladle heating stations. The opportunities are in the areas of: reduction excess O2 in exhaust gases from heating systems, combustion air preheating, and use of improved heating system for tundish heaters.Identified energy saving opportunities includes potential savings varying from $14,800 to more than $270,000 per year for the furnaces/equipment assessed during this visit. Near term (<1 year payback) opportunities identified during this assessment may save 1.5% to 3% and the medium term (< 3 years payback) opportunities may save >3% natural gas cost. The long term (> 3 years) opportunities related to process changes etc. can result in substantially more savings (not estimated at this time).

Those ESA savings opportunities and paybacks were based on a gas price of $8 per million Btu’s (that about $7.89 per thousand cubic feet).

If you go to the top and look at DoE natural gas prices, you will note two important things:

First, gas prices are FALLING, were projected to fall further (from a high of about $18 in early 2008, to less than $6 in 2012). So, just before the 2008 economic collapse, Gerdau management was planning energy conservation investments at the plant.

Obviously, energy prices had very little to do with the closing decision – worse, Bozarth targeted electric energy costs when natural gas is the main source at Gerdau.

Bozarth is wrong about the cause for plant closure, wrong about energy economics and fuel at plant, and relied on a fundamentally wrong economic dynamic – Bozarth is full of shit strike three!

The same people, using the same lies, to promote the same economic interests have falsely claimed that “red tape”, DEP bureaucracy, and environmental regulations have killed jobs and impeded investment.

They have the same credibility as Hal Bozarth’s energy fairy tales.

Pingback: nike apparel 非常にnike sb

Pingback: credit scoring

Pingback: Quantum Vision